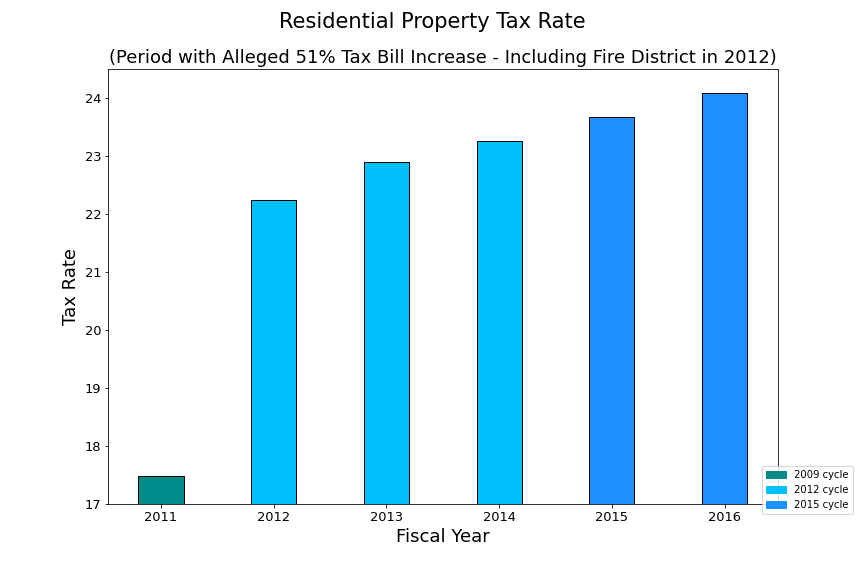

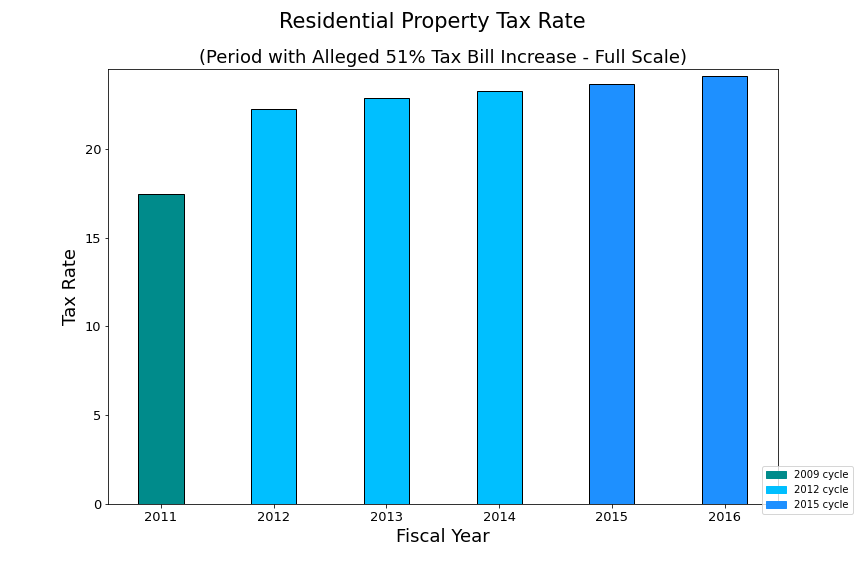

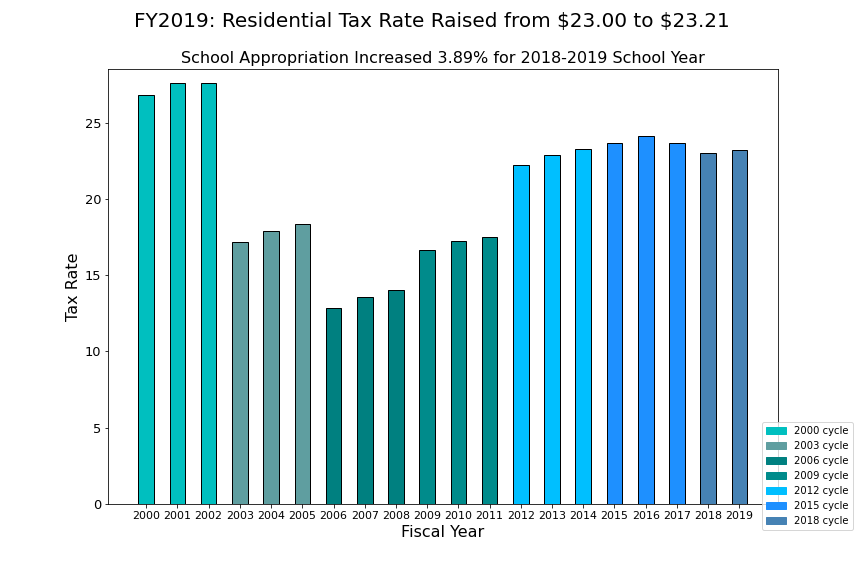

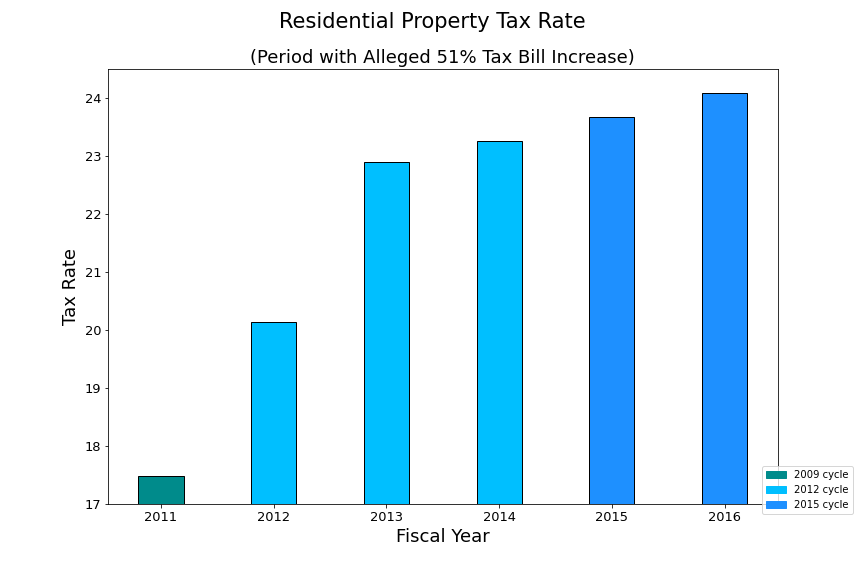

The mailer claimed that over the period from 2011 to 2016, the median property tax bill had risen by 51%, an unsustainable rate.

The actual increase was 14%, but graphs like the one to the left made the 51% number seem plausiible.

There appears to be:

- A big jump from 2011 to 2012

- Another from 2012 to 2013

- Smaller but steady increases in 2014, 2015, and 2016.

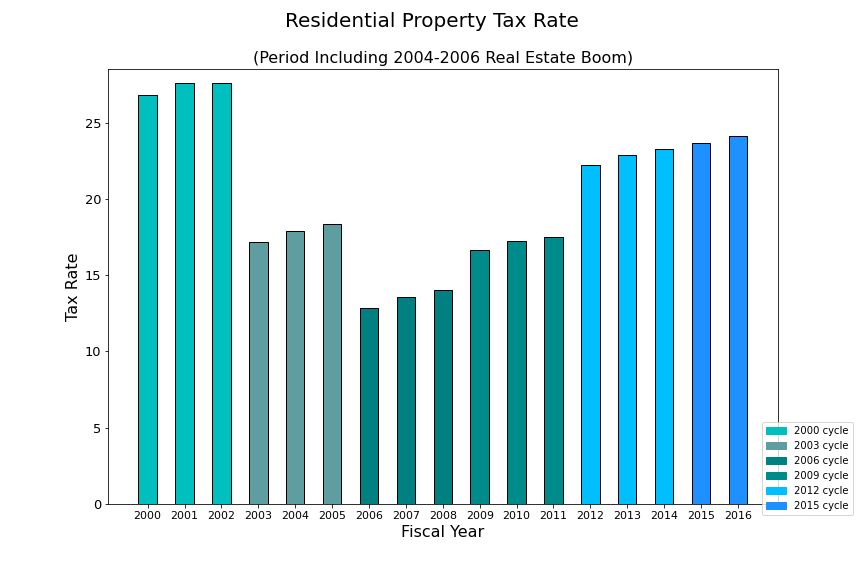

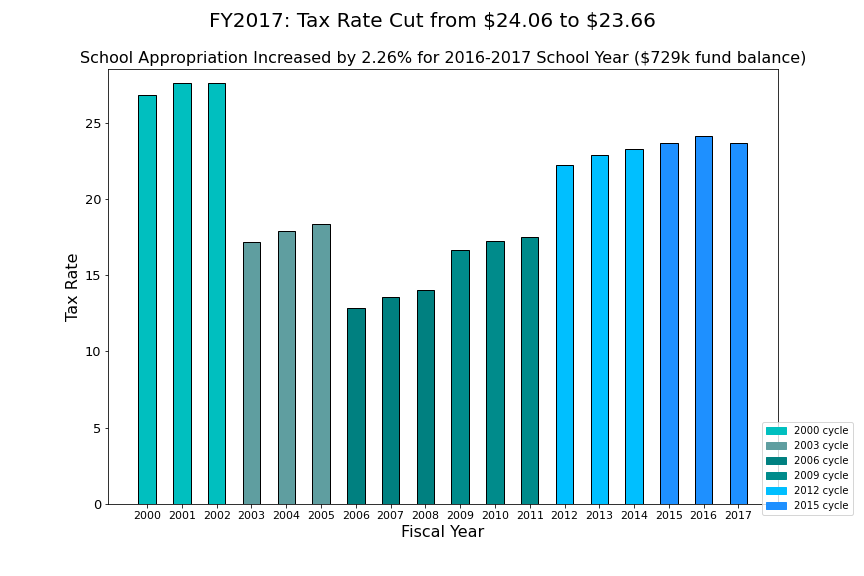

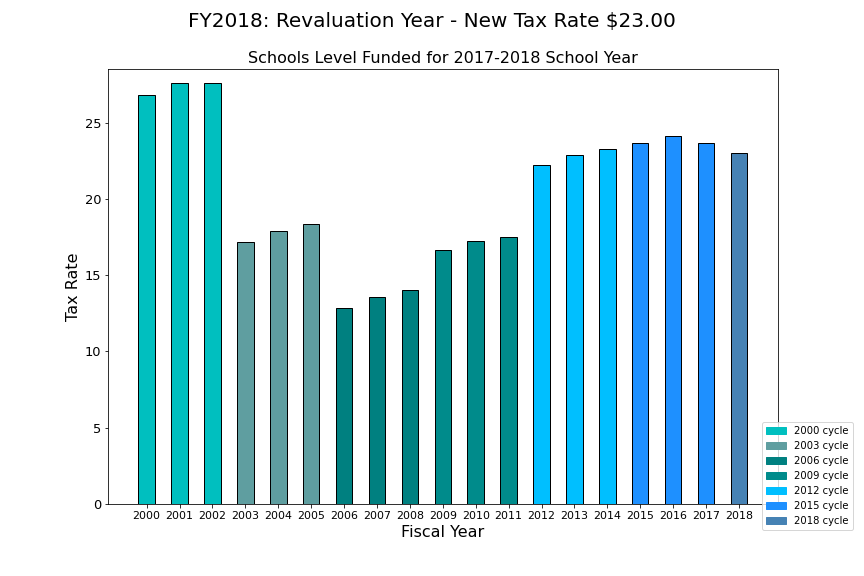

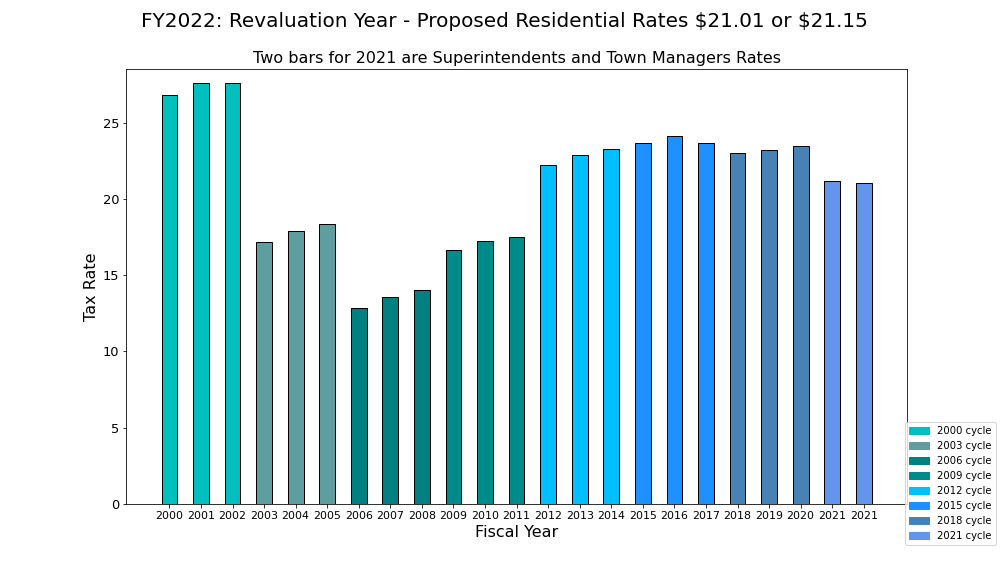

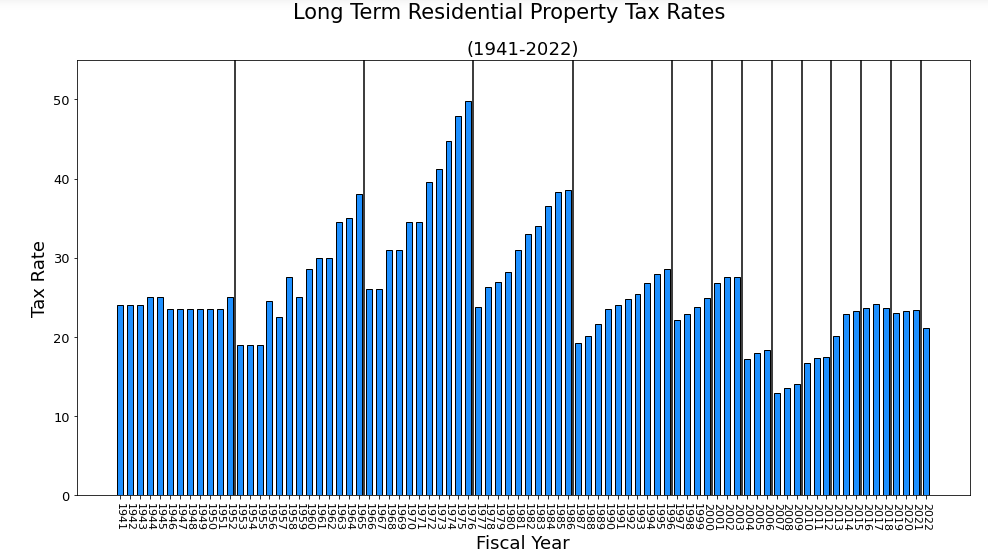

Assessed property values are adjusted in a three year revaluation cycle. The graph is color coded by revaluation cycle.